1031 EXCHANGE RULES is a source for knowledge , guidance and opportunities.

Investors from all over the United States come to this platform to get a better understanding of the 1031 exchange space, the rules and nuances, and how to efficiently navigate the IRS provision to defer capital gains taxes and keep more of what they make.

In addition to being a source of information , 1031 EXCHANGE RULES is also a source of opportunity via a variety of 1031 Exchange offerings for Accredited investors.

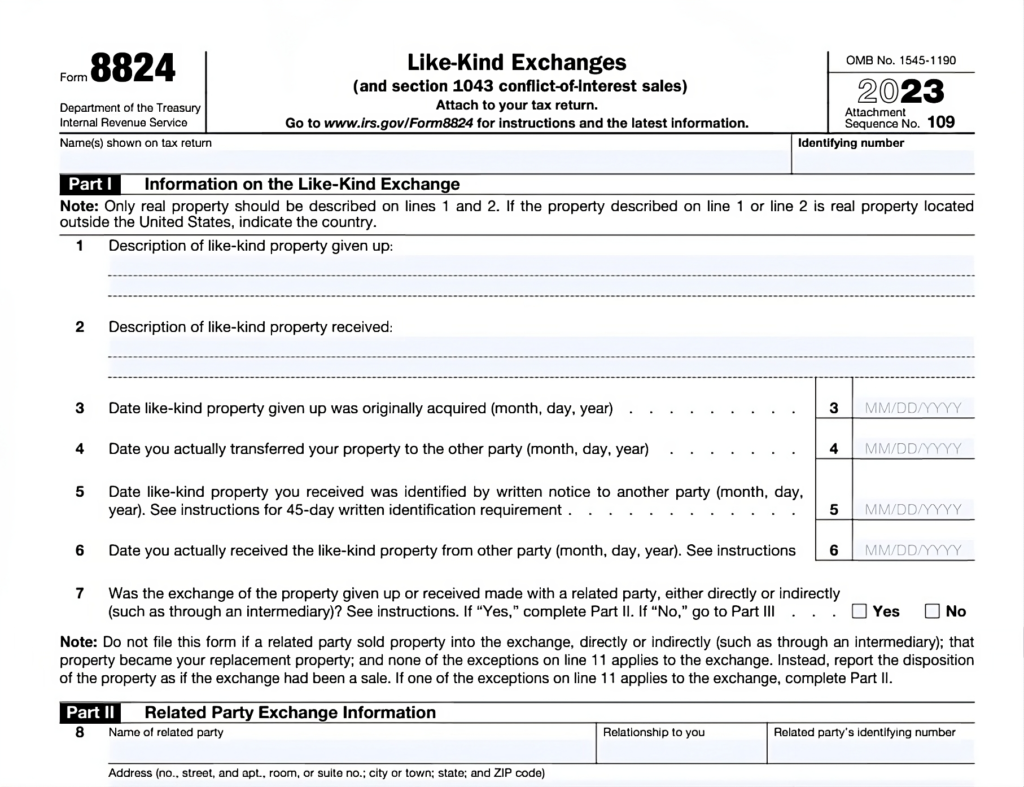

The 1031 Exchange rule is a provision under Section 1031 of the U.S. Internal Revenue Code (IRC) that allows real estate investors to defer paying capital gains taxes when they sell an investment or business-use property and reinvest the proceeds into a similar (like-kind) property. This exchange must follow specific IRS rules and timelines to remain valid.

The 1031 Exchange is a valuable strategy for investors looking to upgrade, consolidate, or diversify their real estate portfolios without the immediate tax burden, helping them grow their investments over time.

While potentially highly advantageous to investors, 1031 Exchanges can be complex and require proper navigation of the Rules to ensure a successful exchange.

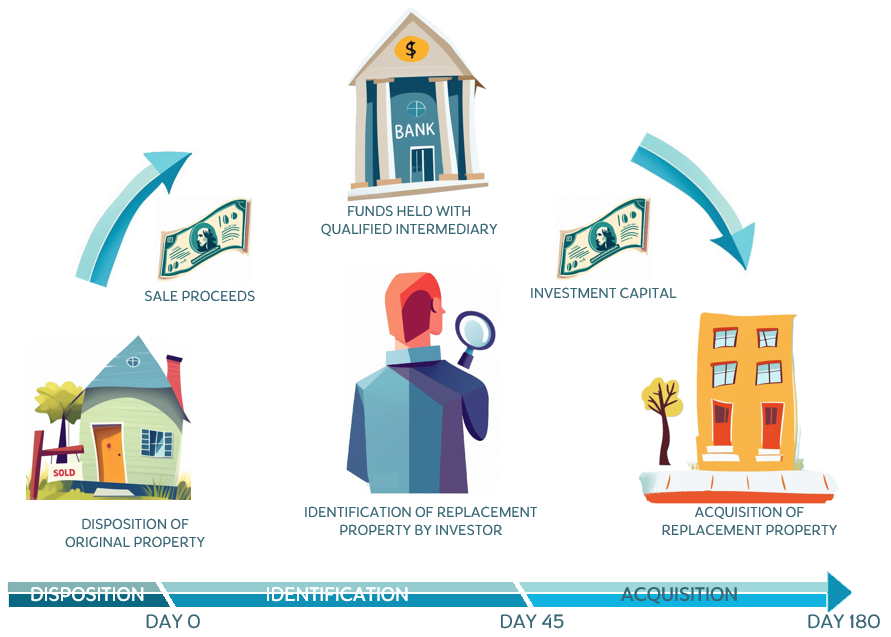

Engaging in a 1031 Exchange can be a powerful strategy for real estate investors looking to defer capital gains taxes and reinvest in like-kind properties. Here’s a step-by-step overview of how the process works:

Navigating the 1031 Exchange process requires a deep understanding of the rules to avoid costly mistakes and maximize tax savings. Our expert financial advisors specialize in guiding investors through the legal requirements and IRS guidelines that govern tax-deferred property exchanges.

Unlock the full potential of your real estate portfolio with expert insights and practical strategies for leveraging the 1031 Exchange. As a responsible and forward-thinking investor, it’s essential to go beyond the basics and dive into topics that impact your investments.

Equip yourself with the right tools and knowledge to succeed as a real estate investor,Accurately project tax savings and stay on top of deadlines with our intuitive calculators, ensuring every step of your exchange meets IRS requirements. Master the terminology with our glossary covering critical tax and real estate vocabulary.

Ready to Maximize Your Investments with a 1031 Exchange?

Let our 1031 exchange specialists guide you through the process and help you unlock the full benefits of a 1031 Exchange.